Wow – What a couple of years it has been!

The Lord continues to be faithful and meet our needs through your generous gifts during this unpredictable time. Thank you!

Here is how we are tracking so far in our fiscal year (as of 10/31/2021):

| Received | $214,894 |

| Needed | $225,000 |

| Difference | -$10,106 |

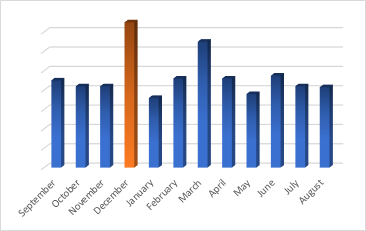

Here is a look at our anticipated giving by month:

You can see how important the month of December is to our annual giving – we budgeted to receive 18% of our gifts in December. This compares to 7.5% on average for all other months of the year. Since our giving is already behind in what’s needed to balance the budget, this December is even more important.

As you reflect on how The Lord has provided for you this year, we wanted to offer several ways to give to Grace Community Church this December.

- Cash / Check brought to / sent to the church (643 W. Gate City Blvd, Greensboro, NC 27403)

- Text (GRACEGSO to 73256)

- Realm

- Website (www.gracegso.org)

- RMD from IRA (for those eligible) *

- Stock gifts*

We also wanted to share some temporary tax law provisions that apply to 20211.

If you itemize on your tax return:

Eligible charitable gifts usually cannot exceed a specific fraction of income. But for gifts in 2021, the law now permits an increased limit, up to 100% of adjusted gross income, for contributions made in cash to qualifying charitable organizations.

If you do not itemize:

Ordinarily, individuals who elect to take the standard deduction cannot claim a deduction for their charitable contributions. The law now permits these individuals to claim a limited deduction on their tax returns for cash contributions made to certain qualifying charitable organizations.

These individuals, including married individuals filing separate returns, can claim a deduction of up to $300. The maximum deduction is increased to $600 for married individuals filing joint returns.

If you own a business the corporate limit also increased – to 25% of taxable income. (See link below for more information on all of these provisions.)

Thank you so much for your prayerful consideration in giving to Grace this year! We appreciate your partnership in making disciples who live from the gospel crossing ethnic and economic lines.

*****

If you have any questions regarding how to give in any of the ways above, please contact Eric Anderson at (336) 455-9355 or Shelly Brazinski at (336) 455-9655.

*If you would like to give from IRA or Stock contact Shelly Brazinski at sbrazinski@gracegso.org.

When mailing your charitable contributions, they must be postmarked no later than Friday, December 31, 2021 in order to be deductible on your 2021 tax return.

Grace Community Church is a 501(c)(3) nonprofit organization.

Disclaimer: This is not tax advice and if you have any questions or uncertainty concerning the tax impact of contributions, we recommend you discuss this with a professional advisor familiar with your particular financial situation before making any decisions.